MyFedLoan is an organization that helps its members manage their college debt. They provide a comprehensive platform that offers a variety of services such as loan consolidation, loan repayment, and counseling. MyFedLoan is part of the U.S. Department of Education’s Federal Student Aid program, so you can be sure that you’re getting the best help available. In this blog, we’ll take a look at what MyFedLoan is all about and how it can help you manage your college debt.

Contents

- 1 What is Myfedloan?

- 2 Benefits of using Myfedloan

- 3 Myfedloan login process

- 4 Fedloan Servicing login process

- 5 Myfedloan phone number

- 6 Common Myfedloan questions

- 7 Myfedloan payment plan options

- 8 Recovery Plan for My Federal Loan

- 9 How does MyFedLoan help with student loans?

- 10 Loan Forgiveness Programs

- 11 How to contact Myfedloan

- 12 Myfedloan customer reviews

- 13 Get Financial Aid from Federal Loan Servicing

- 14 Policy and Regulation

- 15 Conclusion

What is Myfedloan?

MyFedLoan is a loan servicing organization that is part of the U.S. Department of Education’s Federal Student Aid program. It is a non-profit organization that was created to help students manage their college debt. The organization provides loan consolidation and repayment services, as well as debt counseling and other resources. MyFedLoan also has a customer service team that is available 24/7 to answer any questions you may have.

MyFedLoan offers several different loan repayment plans that can help you save money and lower your monthly payments. The organization also provides loan consolidation services, which can help you combine multiple student loans into one loan. This can make it easier to manage your debt and can potentially reduce your interest rate. MyFedLoan also offers counseling services that can help you understand your loan options and make informed decisions.

Benefits of using Myfedloan

MyFedLoan provides a wide range of benefits that can help you manage your college debt. Some of the advantages of using MyFedLoan include:

- Loan consolidation: MyFedLoan can help you combine multiple student loans into one loan, which can make it easier to manage and can potentially reduce your interest rate.

- Loan repayment plans: MyFedLoan offers several different repayment plans that can help you save money and lower your monthly payments.

- Debt counseling: MyFedLoan provides counseling services to help you understand your loan options and make informed decisions.

- 24/7 customer service: MyFedLoan has a customer service team available 24/7 to answer any questions you may have.

- Online resources: MyFedLoan has a website with a variety of helpful resources that can help you understand your loan options and make informed decisions.

All of these benefits can help you manage your college debt more effectively and make it easier to pay off your loans.

Myfedloan login process

If you’re a MyFedLoan member, you can log in to your account to access all of the features and services available to you. To log in, you’ll need to enter your username and password. Once you’re logged in, you can view your loan information, update your personal information, and make payments.

If you’ve forgotten your username or password, you can click the “Forgot Username or Password?” link on the login page. You’ll then be prompted to enter your email address, and MyFedLoan will send you a link to reset your username or password.

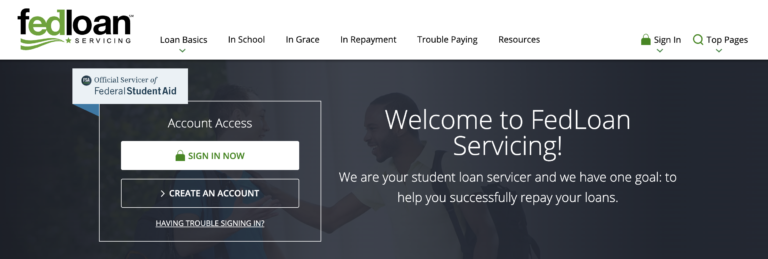

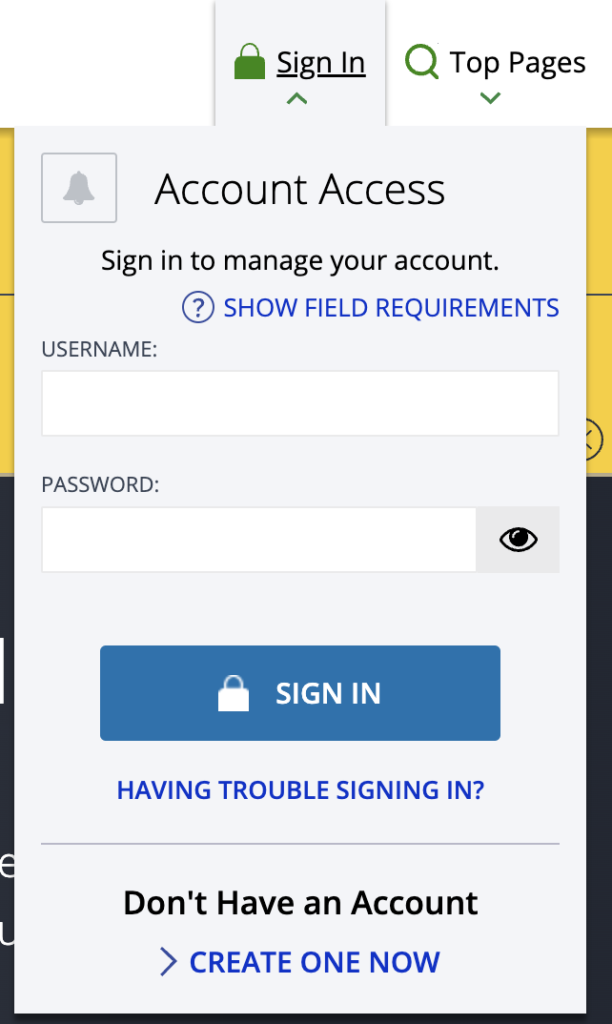

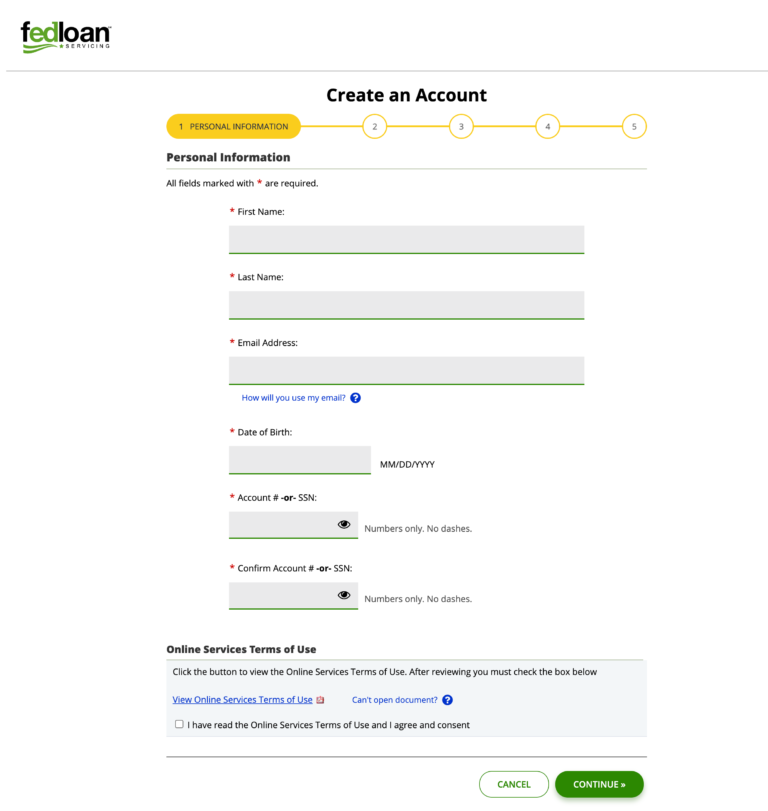

Fedloan Servicing login process

If you’re a member of FedLoan Servicing, you can log in to your account to access all of the features and services available to you. To log in, you’ll need to enter your username and password. Once you’re logged in, you can view your loan information, update your personal information, and make payments.

If you’ve forgotten your username or password, you can click the “Forgot Username or Password?” link on the login page. You’ll then be prompted to enter your email address, and FedLoan Servicing will send you a link to reset your username or password.

Myfedloan phone number

If you need help or have questions about your MyFedLoan account, you can contact their customer service team. The MyFedLoan customer service team is available 24/7, and you can reach them at 1-800-699-2908.

Common Myfedloan questions

If you have questions about your MyFedLoan account, you can visit the MyFedLoan website or contact the customer service team. Some of the most common questions include:

- How do I make a payment?

- How do I change my loan repayment plan?

- How do I consolidate my loans?

- How do I view my loan information?

- How do I update my personal information?

The MyFedLoan customer service team is available to answer any questions you may have.

Myfedloan payment plan options

MyFedLoan offers a variety of payment plan options to help you manage your college debt. Some of the payment plans they offer include the Income-Based Repayment (IBR) plan, the Pay As You Earn (PAYE) plan, the Revised Pay As You Earn (REPAYE) plan, and the Standard Repayment plan. Each of these plans has different eligibility requirements and repayment terms, so it’s important to compare the options and choose the plan that works best for you.

The MyFedLoan website has a helpful tool that can help you compare the different payment plans and choose the right one for you.

Recovery Plan for My Federal Loan

With the help of the system in place, you may better control understudy advances and expedite reimbursement planning. Before using the FedLoan system to make a payment, you should review your payment terms and conditions.

The following suggestions—early payment, consolidation, additional financing, and prompt interest payments—may help speed up and simplify the process. If you want to use MyFedLoan to pay back your student loans, just follow the steps above.

How does MyFedLoan help with student loans?

Using MyFedLoan’s services is a great way to stay on top of your student loan payments. If you are having problems making your payments, you should contact your service provider immediately. Common methods of payment include:

- Throughout the loan’s duration, you will pay the same fixed sum each month.

- In a progressive repayment plan, monthly payments begin low and gradually increase each year.

- Debt-to-income repayment plans consider both your debt and annual income.

- Pay as You Earn, for example, bases its reduced monthly payment on criteria like family size and income.

- In most of these programmes, student loans are dischargeable after twenty to twenty-five years of payments.

- Oh well, difficulties are inevitable. If a borrower experiences temporary financial difficulties and is unable to make their loan instalments, FedLoan may grant them a deferment or forbearance. If you choose this path, you will not advance further than where you are now.

Loan Forgiveness Programs

There are a number of loan forgiveness programs that can help people handle their student debt and eventually get rid of it. Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and other government options for loan forgiveness are some of these programs.

Public Service Loan Forgiveness (PSLF)

The Public Service Loan Forgiveness (PSLF) scheme is for people who work for qualifying non-profits or federal, state, local, or tribal governments in the United States. To be eligible, borrowers must make 120 qualifying payments on a repayment plan that is accepted while working full-time for a company that is eligible.

One important thing to know is that PSLF can only be used for Direct Loans. People who have other kinds of government loans can combine them into a Direct Consolidation Loan in order to be eligible. Since the program has been changed and made better, it is important to check for specific needs and new information.

Teacher Loan Forgiveness

You can get your teacher loans forgiven if you work full-time in a low-income school or educational service agency for five full academic years in a row. Direct Subsidized and Unsubsidized Loans, as well as Subsidized and Unsubsidized Federal Stafford Loans, can be canceled up to $17,500 for teachers who fit the criteria.

Teachers have to meet high standards each year in order to be considered. People who do volunteer work in schools that don’t get enough help will benefit from this choice for forgiveness.

Other Forgiveness Options

People who are in certain types of repayment plans, like Income-Driven Repayment (IDR) plans, may be able to get their government loans forgiven through other programs. If you make payments toward these plans for 20 to 25 years, based on the plan, the loan balance may be forgiven.

Temporary Expanded Public Service Loan Forgiveness (TEPSLF) helps borrowers even more who were turned down for PSLF at first but passed other requirements. Recent changes and court rulings, such as the Biden-Harris Administration’s efforts to deal with student debt, may also make it easier to get forgiven. Borrowers should know about new policies and choices as they come out.

How to contact Myfedloan

If you need help or have questions about your MyFedLoan account, you can contact their customer service team. The MyFedLoan customer service team is available 24/7, and you can reach them at 1-800-699-2908.

You can also visit the MyFedLoan website to find helpful resources, such as FAQs and tutorials. The website also has a contact form where you can submit your questions and get help from the customer service team.

Troubleshooting Common Issues

MyFedLoan makes it easy for users who are having trouble logging in or getting to their accounts to fix the problems. Using the wrong password or an old email address can cause a lot of problems.

Users should make sure they are using the right passwords for their MyFedLoan account to avoid these issues. If you forget your username or password, MyFedLoan’s website has a tool that lets you reset it. Log-in problems can also be avoided by keeping your contact information up to date.

Getting Help with Payments

Customers who are having issues with MyFedLoan can easily fix the issues. A bad password or an old email address can make things very difficult.

These problems can be avoided by making sure that users are using the right passwords for their MyFedLoan accounts. There is a tool on MyFedLoan’s website that can help you change your username or password if you forget them. You can also avoid having trouble logging in by making sure your contact information is always up to date.

Myfedloan customer reviews

MyFedLoan has a lot of satisfied customers who are happy with the services they provide. On the MyFedLoan website, customers have left positive reviews about the organization, praising their helpful customer service team and convenient online tools.

Many customers have also commented on how MyFedLoan has helped them manage their college debt and lower their monthly payments. Customers have also praised MyFedLoan’s loan consolidation services, saying that it has made it easier to manage their loans and has saved them money.

Get Financial Aid from Federal Loan Servicing

If you have no idea how to manage your student loan debt and are drowning in it, consulting with a Chartered Financial Analyst (CFA) could be a good next step (CFA). Check out FedLoan Servicing’s Student Loan Planner if you’re having trouble devising a strategy to repay your student loans. Access your student loan calculator here.

Federal Direct Consolidation Loan (FedLoan) refinancing and consolidation of student loans should be considered only if doing so makes financial sense. Although there are numerous options available to you, I recommend beginning with Credible. Benefits the trustworthiness of student loans.

After completing out a single application, you will be given with loan options from many lenders. Private lenders Credible works with are guaranteed to be trustworthy, so you can feel much more comfortable contacting and working with them than with the bureaucratic FedLoan.

Policy and Regulation

MyFedLoan is very important for helping people handle their Federal Student Loans because it follows the rules set by the U.S. Department of Education. New laws have changed how borrowers use the system, and it is very important that they follow these new rules.

Recent Legislative Changes

The management of student loans has been made more efficient by making big changes. The Public Service Loan Forgiveness (PSLF) Program has been completely redesigned to help public service workers get out of debt faster and easier. The new PSLF rules call for a centralized and streamlined processing method. This will cut down on delays by a large amount.

Also, the rules for complying with job verification have been made easier to understand. For example, part-time and temporary teachers now get credit for at least 3.35 hours of work for every credit hour they teach. This makes it easier for them to apply for PSLF. These changes to the law are part of a larger attempt to make managing student loans more fair and effective.

Understanding Compliance

It is very important for both borrowers and servicers like MyFedLoan to follow government rules. People who want to apply must work full-time for qualifying groups like tribal, state, local, or federal governments. To get PSLF benefits, borrowers should make sure they have Direct Loans or change other government loans into Direct Loans.

To stay in compliance, you need to keep correct records and make sure there are regular updates. Borrowers should confirm their employment situation and loan payments every month to avoid any problems. People who take out government student loans can get the most out of them by following these rules.

Not only does compliance mean following the rules, but it also means knowing how federal student loans work. This means they know about due dates, the paperwork they need, and any policy changes that might affect their payback plans.

Conclusion

MyFedLoan is a great organization that can help you manage your college debt. They provide a variety of services, such as loan consolidation and loan repayment plans, that can help you save money and lower your monthly payments. MyFedLoan also has a customer service team available 24/7 to answer any questions you may have.

If you’re looking for help managing your college debt, MyFedLoan is a great option. With their comprehensive platform and dedicated customer service team, they can help you make informed decisions and get the most out of your college debt. So don’t wait any longer – check out MyFedLoan today and start managing your college debt the right way.